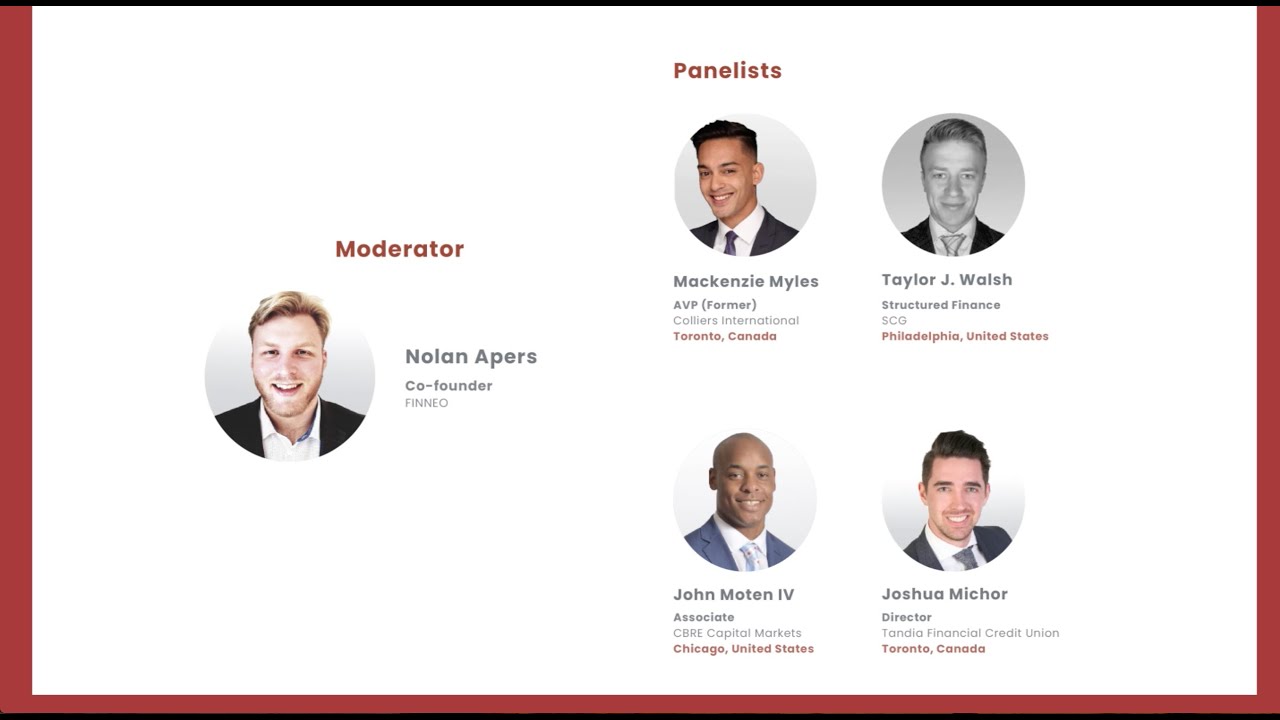

Q4 2020 CRELA Webinar - "Has the CRE Industry undergoing a Tectonic Shift?"

- Nov 25, 2020

- 2 min read

Discussion Points:

Pre-Pandemic, the apartment sector was very buoyant and posted some of the best returns (similarly to the Industrial sector). However, since March, the immigration levels have slowed down, unemployment levels have gone up, and there is a lingering concern about rent collection. Our panelists discussed:

1. Rent Collection

2. Rent growth / decline (as applicable by market and asset type)

3. How have 1 and 2 above been offset with sub 2% financing rates?

4. Project economics for new construction of rental?

MidTown Manhattan and other CBD markets have become "Ghost Towns” over the last several months. In most buildings the actual occupancy is <10%. In this context, it’s logical to think about alternate uses for these buildings. If the prices of condos in these neighbourhoods are strong and rents are increasing, the economic case is easier to make, but then again there are challenges with reconfiguring these properties from a structural standpoint. Our panelists discussed:

1. Would you be a buyer of office buildings in this market for repositioning?

2. Suburban office vs downtown CBD class A office market - how stark is the performance at the present time?

3. Are you seeing any tax incentives being offered by the local municipalities for conversion to residential/affordable housing?

While the retail sector has gotten a lot of bad press; a lot of your real estate is unique: it’s neighbourhood strip centers or gas station type essential service retail.

1. What are your comments on Occupancy levels and rent recoveries on your properties?

2. Shifts in the retail industry: Experience vs Convenience? In person vs Online?

On Industrial Topic:

1. What are you seeing within the Industrial space?

2. Given the cost of land, are secondary markets seeing an increase in industrial activity?

3. Where is the cost of land today compared to pre-pandemic levels?

4. What kind of development yields are you able to obtain in today’s market - Rents are higher than a year ago, but how does that tie into the overall project proforma?

5. Are the yields higher or lower?

6. How is the capital flow from institutional investors today for development of industrial?

7. Any bias towards rental vs strata product?

Comments